What do we need to unlock the card and get up to 50 mx/s on RTX 3060?

The list of key components to work the card without blocking:

- Video card RTX 3060;

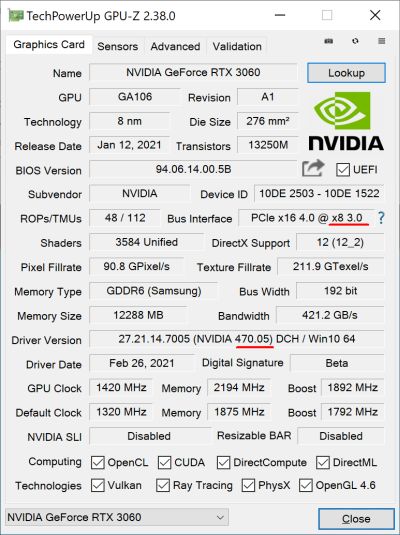

- a motherboard that supports PCIe 3.0 or PCIe 4.0 on 8 or 16 lanes;

- monitor, TV or HDMI emulator;

- Windows 10 operating systems;

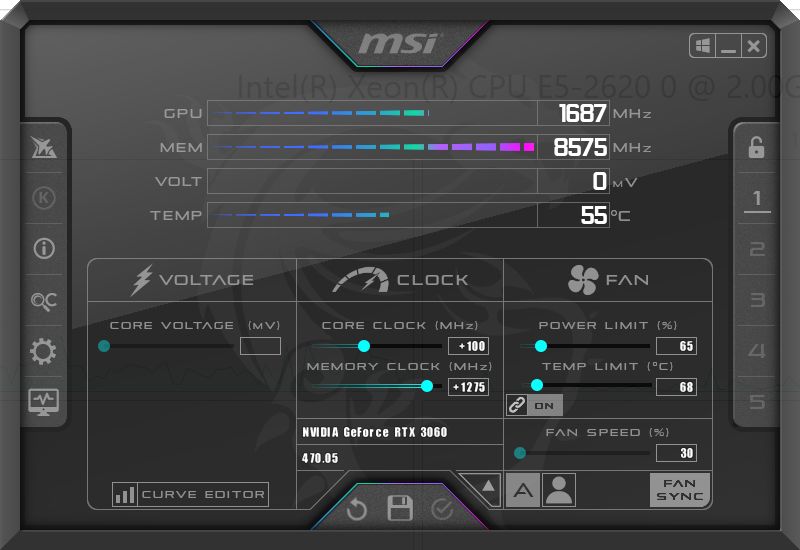

- GeForce 470.05 drivers;

- mining software supporting CUDA 11, such as T-REX.

Mining farm at RTX 3060

In view of the features we shall specify what we need to collect RIG on several cards.

- Firstly, it is several RTX 3060 cards;

- A motherboard with connectors (for each card) of PCI Express 16x* that will run on at least version 3.0 and have 8 lanes;

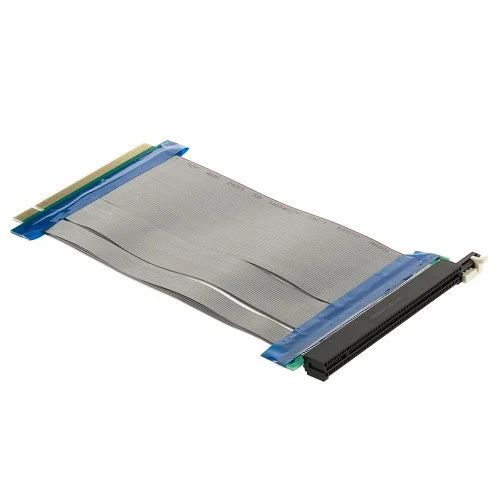

- Riser 16x to 16x *;

- HDMI emulator.

* – May also work on PCIe 8x connector through 8x to 16x. However, there is no confirmation of this work yet.

The number of risers and HDMI emulators can be smaller than the video card, as a monitor can be connected and a video card can be inserted directly into the motherboard. Before purchasing a motherboard and CPU, make sure that they support at least PCIe 3.0 8x for each video card.

Example of a farm on RTX 3060

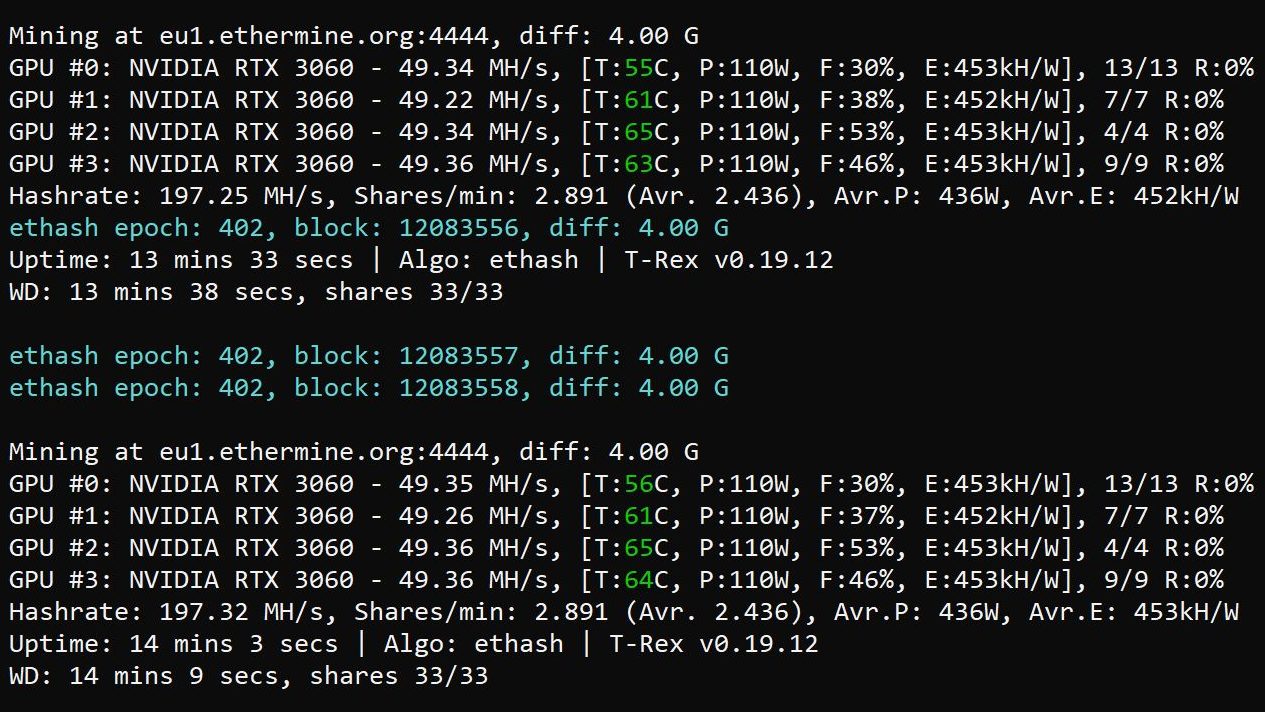

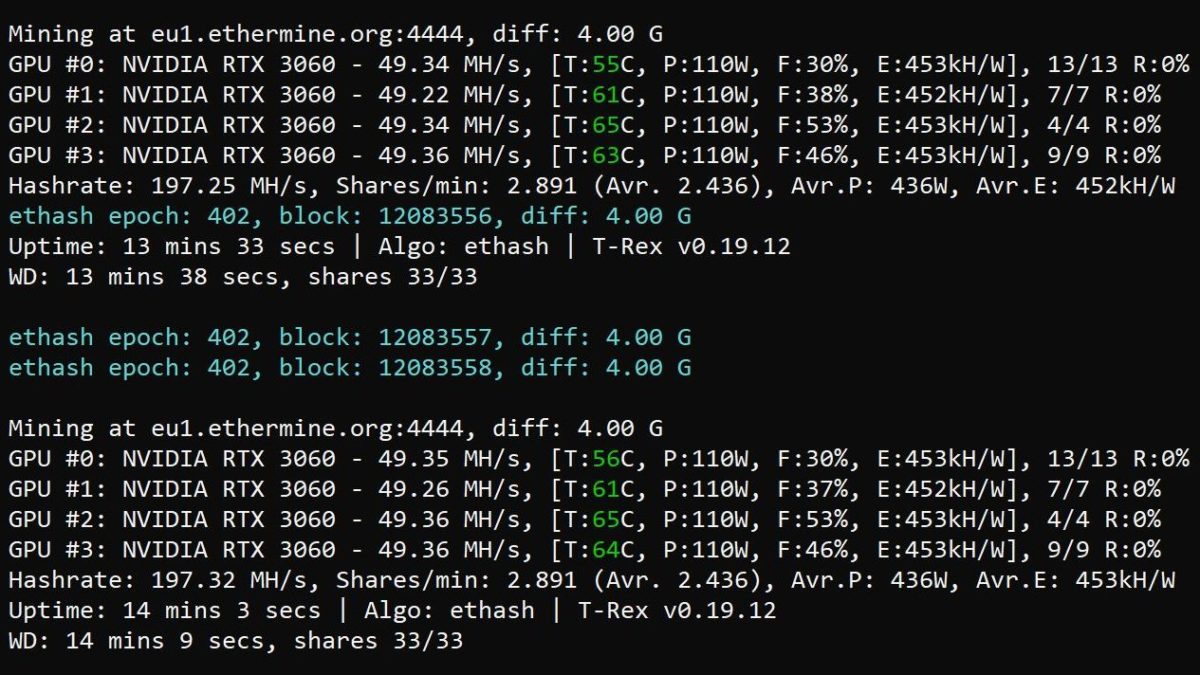

Here is an example of a 4-card RIG RTX 3060 with unlocked hashrate.

- 4 x INNO3D GEFORCE RTX 3060 TWIN X2 OC;

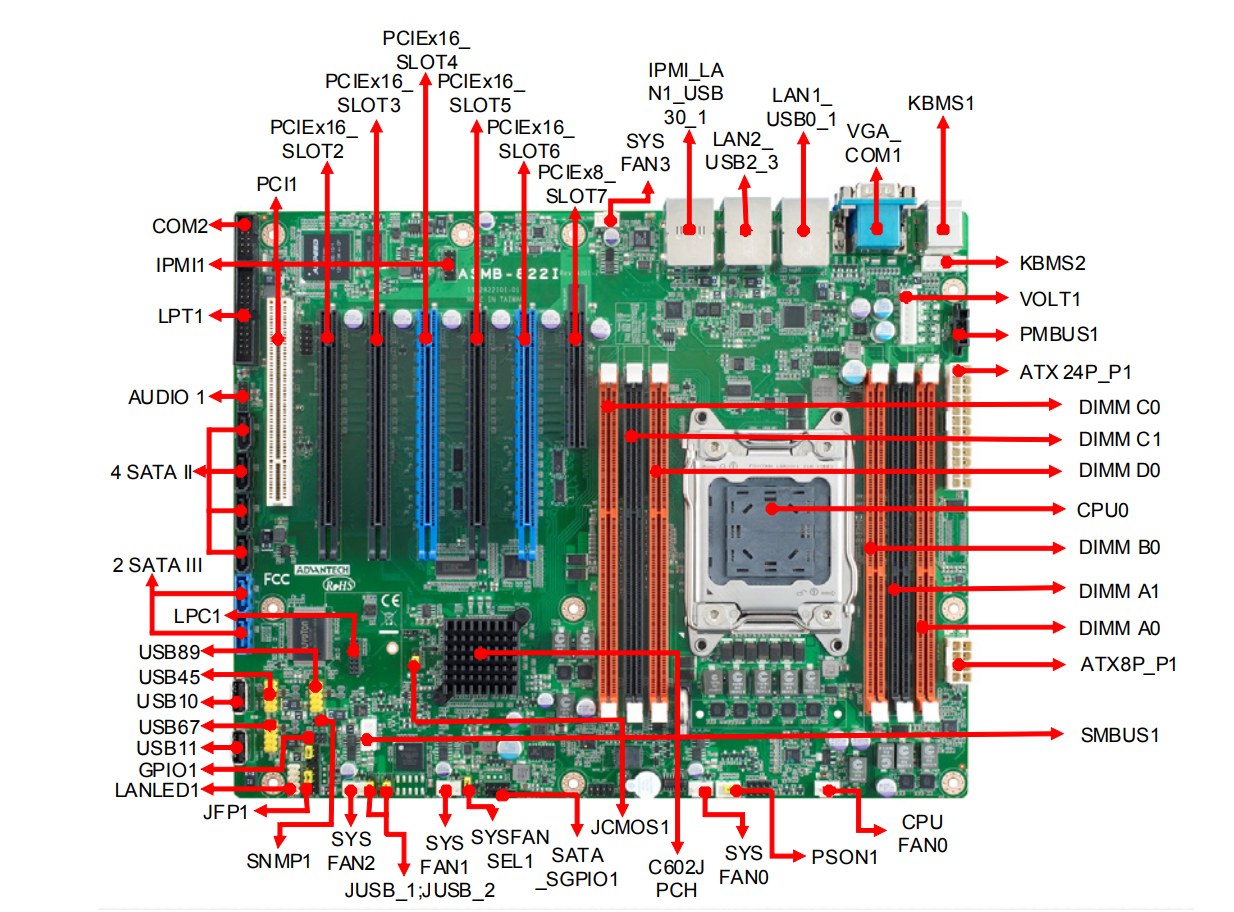

- Advantech ASMB-822I server motherboard (5 PCIe 3.0 operating in x8 x8 8 x8 x8);

- Intel® Xeon® E5-2620 processor (40 lanes PCIe 3.0);

- 12 GB of memory;

- 4 x risers x16 to x16;

- 4 HDMI to VGA adapters operating as HDMI emulator;

- EMERSON 1450W Server Power Unit.

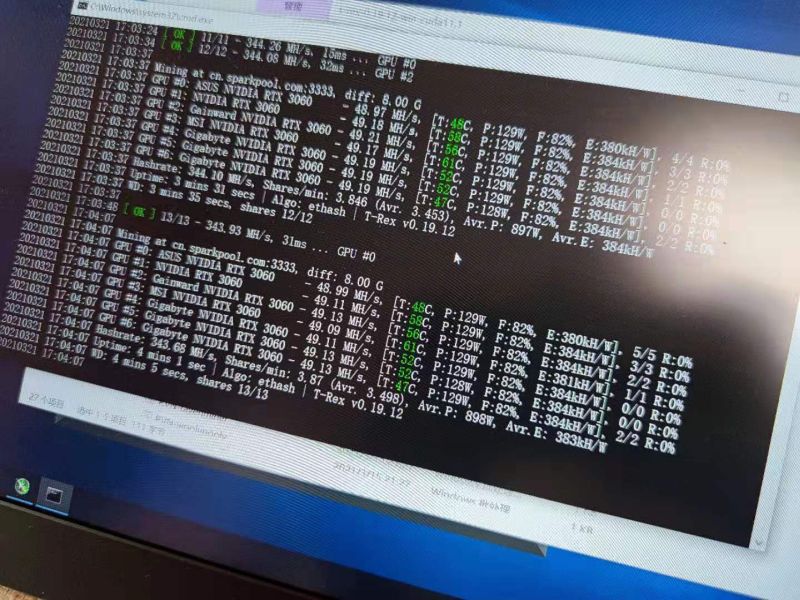

At the time of writing, the farm was operating steadily for more than a day with 197 MX/s hashrate, consuming about 565 W. Another PCIe x16 connector is free.

By default this motherboard with 4 cards does not start, it is necessary to enable the Above 4G Decoding option in BIOS. Also in BIOS you need to switch PCI Express from version 2 to version 3 for all video cards.

A couple of words about the prices of RIG: used motherboard+CPU+cooler+memory cost only $110, risers for $5, adapters HDMI for $2.6, used power unit – $110, used rack – $9. Everything was bought at the place in Ukraine, on Aliexpress can be cheaper.

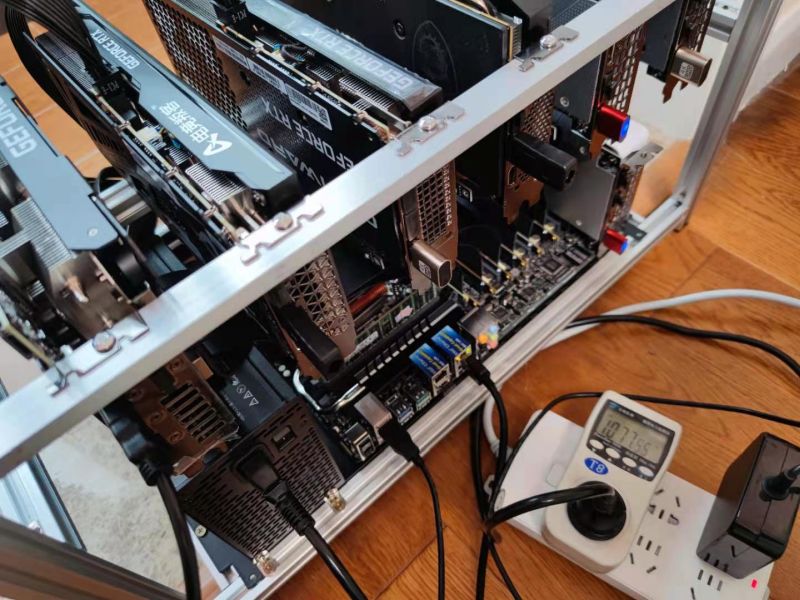

Example with maximum RTX 3060 on the RIG

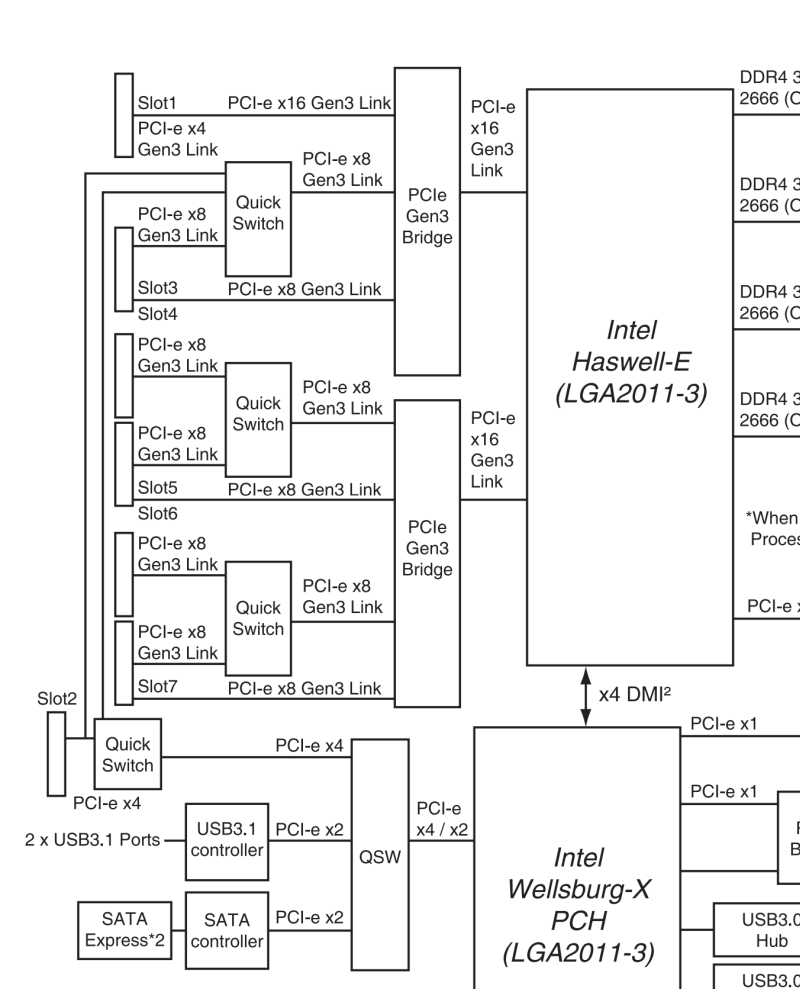

The user ben19910518 at the Guru3D.com forum shared information about his farm of 7 * RTX 3060 cards. The hashrate on the Ether is 343MH/s. RIG consumes 1077 W. It is based on the Asus X99-E WS / USB3.1 motherboard and the Intel® Xeon® E5-2690 v4 processor.

An interesting fact is that the CPU has 40 PCIe lanes, but the motherboard essentially doubles the number of lanes for a video card to x16/x8/x8/x8/x8/x8/x8/ = x64. The PCIe work diagram and the specification reference are listed below.

Ethereum Mine Unlock on RTX 3060 not working

Several tips how to check that everything is configured correctly in case RTX 3060 still continues to mine at half power.

Use the GPU-Z to make sure that the correct version of drivers (470.05) is installed and that at least 8 PCIe 3.0 lanes are used for each card. Watch the number of lanes and the PCIe version under load (mining). In idle video cards go to energy saving mode.

When connecting HDMI adapters in the Device Manager “Generic PnP Monitor” should appear.

How to choose a motherboard and a CPU for the RTX 3060?

Ensure that motherboard supported at least PCIe 3.0 x8 for each card.

Consider specification the above Advantech ASMB-822:

PCIexpress 5 x PCIe x16 slot (Gen3 x8 Link) 1 x PCIe x8 slot (Gen2 x4 link) 1 x PCI PCIEX16_SLOT6 PCIe x16 slot (x8 or x16 link) PCIEX16_SLOT5 PCIe x16 slot (x8 link) PCIEX16_SLOT4 PCIe x16 slot (x8 or x16 link) PCIEX16_SLOT3 PCIe x16 slot (x8 link) PCIEX16_SLOT2 PCIe x16 slot (x8 link)

All five cards are gonna work.

Another example is a special motherboard for mining ASRock X370 Pro BTC+. 8 x PCIe x16, 6 x mining ports, but no ports with 8 lanes:

AMD 7th A-Series APUs

- 8 x PCI Express x16 Slots (PCIE1 at x4; PCIE2~8 at x1)

- 5 x Mining Ports (M_Port1, 3, 4, 5, 6 at x1, M_Port2 N/A)*

AMD Ryzen series CPUs (Picasso, Summit Ridge, Raven Ridge and Pinnacle Ridge)

- 8 x PCI Express x16 Slots (PCIE1 at x4; PCIE2~8 at x1)

- 6 x Mining Ports (M_Port1~M_Port6 at x1)*

In this motherboard, no RTX 3060 will work at full capacity.

And an example of ASRock X370 Taichi.

2 PCIe 3.0 x16, 1 PCIe 2.0 x16, 2 PCIe 2.0 x1

AMD Ryzen series CPUs (Matisse, Summit Ridge and Pinnacle Ridge)

- 2 x PCI Express 3.0 x16 Slots (single at x16 (PCIE2); dual at x8 (PCIE2) / x8 (PCIE3))

AMD Ryzen series CPUs (Matisse, Raven Ridge)

- 1 x PCI Express 3.0 x16 Slot (single at x8 (PCIE2))

AMD Athlon series CPUs

- 1 x PCI Express 3.0 x16 Slot (single at x4 (PCIE2))

Finally the Intel® Celeron® G3900 specification:

PCI Express 3,0 PCI Express Up to 1x16, 2x8, 1x8+2x4

You can run two video cards on it.

Links to download

- NVIDIA GeForce 470.05

- T-Rex 0.19.12

- GPU-Z

- Advantech ASMB-822 specification

- Asus X99-E WS / USB3.1 specification

Please leave your questions in the comments.

13 thoughts on “RTX 3060 gives 50 MH/s on Ethereum”

Comments are closed.